How to Finance an Arcade Center Startup: Practical Options for Founders

- How to Finance an Arcade Center Startup: Overview and First Steps

- Why financing matters for an arcade center startup

- Estimate Your Startup Costs and Funding Gap

- Calculate realistic startup costs and capital needs

- Prepare a Bankable Business Plan and Financial Projections

- Create a lender-ready business plan

- Debt Financing Options

- Small business loans and SBA financing

- Equipment leasing and financing

- Business lines of credit and merchant cash advances

- Equity Financing Options

- Angel investors and local partners

- Venture capital and revenue-sharing investors

- Crowdfunding and Community-Based Funding

- Use crowdfunding to validate concept and raise pre-sales

- Bootstrapping, Personal Savings and Friends & Family

- Bootstrap strategically to retain control

- Optimize Costs: Purchasing, Supplier Negotiation, and Trade Terms

- Lower upfront capital with smart supplier choices

- Operational Financing: Managing Cash Flow After Opening

- Forecast and manage working capital

- Mitigate Risk with Phased Growth and Pilot Locations

- Test with smaller footprints and pop-ups

- Tax Incentives, Grants and Local Support

- Explore grants and local incentives

- Build a Strong Financial Pitch and Due Diligence Package

- Present credible numbers and risk mitigation

- Case Study: Typical Financing Mix for a Mid-Sized Arcade Center

- Example capital structure

- Why Choose Guangzhou Dinibao as Your Purchasing and Planning Partner

- Supplier advantages and one-stop service

- Checklist: Steps to Finance an Arcade Center Startup

- Actionable financing checklist

- Conclusion: Financing with a Strategic, Balanced Approach

- Balance risk, control and growth

- Frequently Asked Questions

How to Finance an Arcade Center Startup: Overview and First Steps

Why financing matters for an arcade center startup

Securing the right financing is critical when starting an arcade center. Startups need capital for arcade machines, leasehold improvements, rent deposit, staffing, working capital, marketing, and safety/compliance. Knowing how to finance an arcade center startup reduces risk and speeds time-to-market.

Estimate Your Startup Costs and Funding Gap

Calculate realistic startup costs and capital needs

Before asking lenders or investors, create a detailed budget. Typical cost categories include: arcade machines and redemption systems, token/card transaction hardware, interior build-out and themed decoration, HVAC and electrical upgrades, signage and permits, initial inventory (prizes, F&B if applicable), staffing and training, and 3–6 months working capital. Depending on size, location, and concept, initial investment generally ranges from about $50,000 for a kiosk or small arcade corner to $500,000+ for a mid-sized family entertainment center (FEC). Outline a conservative scenario and an expansion scenario to determine your funding gap.

Prepare a Bankable Business Plan and Financial Projections

Create a lender-ready business plan

Lenders and investors look for clarity: location analysis, target customer segments (families, teens, tourists), revenue streams (play, parties, food & beverage, redemption prizes, events), marketing plan, and competitive differentiation. Include realistic financial projections: monthly cash flow for year one, break-even analysis, 3–5 year P&L, and capital expenditure schedule. Use local market data; if you partner with an experienced supplier like Guangzhou Dinibao Animation Technology Co., Ltd., you can include supplier quotes and installation timelines to strengthen credibility.

Debt Financing Options

Small business loans and SBA financing

Traditional bank loans and SBA-backed loans are common choices. The U.S. Small Business Administration (SBA) 7(a) loan program can provide up to $5 million with competitive rates and longer terms—useful when buying property or large equipment. Equipment loans specifically finance machines and usually offer terms of 3–7 years. Lenders will evaluate credit history, business plan, collateral, and industry experience.

Equipment leasing and financing

Equipment leasing lets you acquire arcade machines with lower upfront costs. Leasing companies often finance 80–100% of equipment value and may include maintenance packages. This preserves working capital and can be structured as operating leases (off-balance monthly payments) or capital leases (eventual ownership). For many arcade startups, leasing new or refurbished machines from a supplier like Guangzhou Dinibao reduces initial cash outlay and speeds fit-out.

Business lines of credit and merchant cash advances

A business line of credit provides flexible working capital for seasonal dips or inventory purchases. Merchant cash advances provide quick cash based on future card sales but tend to carry higher costs—use cautiously. For predictable monthly expenses and ramp-up needs, a line of credit is often preferable.

Equity Financing Options

Angel investors and local partners

If you’re comfortable giving up a share of ownership, angels or strategic partners can bring capital and industry expertise. Local investors who understand entertainment or retail can also support site selection and introductions to local chains. Be prepared to present a clear equity pitch: how much ownership you offer, expected return timeline, and exit options.

Venture capital and revenue-sharing investors

VC is less common for standalone arcades unless you scale into a multi-location chain or integrate unique technology. Revenue-based financing (RBF) is an alternative where investors receive a percentage of revenues until a cap is repaid—useful if you expect steady cash flow but want to avoid equity dilution.

Crowdfunding and Community-Based Funding

Use crowdfunding to validate concept and raise pre-sales

Platforms like Kickstarter or Indiegogo can help raise capital while validating demand. Offer rewards such as season passes, VIP grand-opening packages, or corporate party packages. Local community funding (neighborhood loans, cooperative investors) can also generate smaller sums with strong local buy-in.

Bootstrapping, Personal Savings and Friends & Family

Bootstrap strategically to retain control

Many founders start with personal savings and small contributions from friends and family to cover early costs and secure a lease. This approach retains full control but increases personal financial risk. Combine bootstrapping with equipment financing or leasing to conserve cash.

Optimize Costs: Purchasing, Supplier Negotiation, and Trade Terms

Lower upfront capital with smart supplier choices

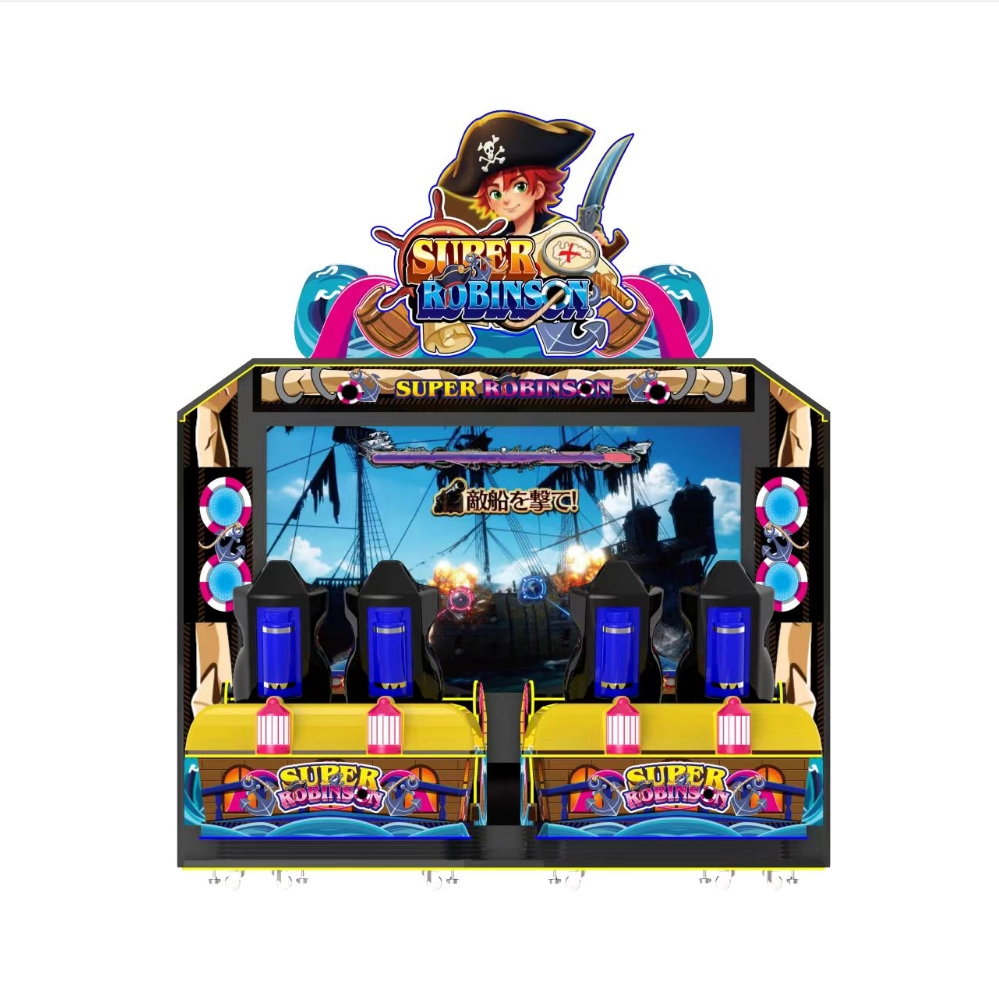

Negotiating favorable terms with equipment suppliers reduces cash needs. Guangzhou Dinibao Animation Technology Co., Ltd. offers cost-effective, high-quality arcade machines and one-stop purchasing solutions—market research, planning, theme and decoration design, operation guidance—helping lower procurement risk and streamline installation. Ask suppliers about bundle discounts, deferred payments, and installation packages to conserve capital.

Operational Financing: Managing Cash Flow After Opening

Forecast and manage working capital

Post-opening cash flow management is crucial. Build a cash reserve for slow months and unexpected repairs. Track KPIs: average revenue per player, redemption cost per prize, cost per attraction, and revenue per square foot. Break-even typically occurs when monthly fixed costs are covered by consistent play and ancillary sales (F&B, parties). Maintain a line of credit to handle seasonal variability or expansion opportunities.

Mitigate Risk with Phased Growth and Pilot Locations

Test with smaller footprints and pop-ups

Consider starting with a smaller footprint, pop-up locations, or placement within malls and family entertainment centers to validate concept with less capital. A phased approach—start small, refine operations, then scale—reduces capital intensity and increases investor confidence when you seek follow-on funding.

Tax Incentives, Grants and Local Support

Explore grants and local incentives

Some municipalities offer small business grants, tax incentives, or low-interest loans to encourage local retail and entertainment businesses. Check local economic development offices for façade-improvement grants, job-creation incentives, or small business support programs that can reduce upfront costs.

Build a Strong Financial Pitch and Due Diligence Package

Present credible numbers and risk mitigation

Investors and lenders want numbers and mitigation plans. Include sensitivity analysis (best-case/worst-case), clear timelines for customer acquisition, and vendor agreements (e.g., machine purchase/lease terms with Guangzhou Dinibao). Provide references from other centers using your supplier when possible—Dinibao has supplied machines to over 10,000 game centers in 180+ countries, which can strengthen supplier credibility.

Case Study: Typical Financing Mix for a Mid-Sized Arcade Center

Example capital structure

Estimated total startup cost: $250,000 (landlord improvements $80k, machines $70k, F&B and POS $30k, working capital and marketing $40k, permits/equipment $30k). Possible financing mix: 40% owner equity ($100k), 30% equipment lease ($75k), 20% bank term loan ($50k), 10% local incentives or crowdfunding ($25k). This blended strategy reduces dilution and spreads risk while using lease financing to preserve working capital.

Why Choose Guangzhou Dinibao as Your Purchasing and Planning Partner

Supplier advantages and one-stop service

Guangzhou Dinibao Animation Technology Co., Ltd. has 18 years manufacturing experience, exports to 180+ countries, and supplies more than 10,000 game centers. Dinibao positions itself as the only supplier offering low prices with strong quality, plus full-service solutions: market research, project analysis, theme and decoration design, operation consulting, and global after-sales service. Using an experienced supplier reduces procurement risk and helps when presenting financing proposals to lenders and investors.

Checklist: Steps to Finance an Arcade Center Startup

Actionable financing checklist

1) Build a detailed startup budget and cash flow forecast. 2) Identify preferred financing mix (debt, lease, equity, crowdfunding). 3) Prepare lender-ready business plan and pitch deck. 4) Get equipment quotes and lease terms from suppliers like Dinibao. 5) Apply for SBA or bank loans, and compare equipment leasing offers. 6) Secure contingency funding (line of credit). 7) Finalize site lease and sign vendor agreements. 8) Track KPIs and maintain transparent reporting for investors.

Conclusion: Financing with a Strategic, Balanced Approach

Balance risk, control and growth

How to finance an arcade center startup comes down to balancing capital sources to meet cash needs while managing ownership and risk. Combine conservative projections, supplier partnerships, flexible leasing, and staged growth to reduce upfront capital and boost long-term success. Partnering with an experienced manufacturer and planner like Guangzhou Dinibao can shorten your timeline, lower procurement costs, and strengthen your financing case with lenders and investors.

Frequently Asked Questions

What is the typical range of startup costs for an arcade center?Typical startup costs vary widely. Small arcade corners or kiosks might start around $50,000. A mid-sized family entertainment center commonly ranges from $150,000 to $500,000 depending on location, machines, fit-out, and F&B offerings. Create detailed local cost estimates before committing.

How much financing should I try to secure before opening?Aim to cover initial fixed costs plus 3–6 months of operating expenses as working capital. This reduces the risk of running out of funds during the ramp-up period.

Can I lease arcade machines instead of buying them outright?Yes. Equipment leasing is a common strategy to reduce upfront costs. Leasing companies often finance most of the equipment value and can include maintenance options. Discuss lease-versus-buy scenarios with suppliers like Guangzhou Dinibao.

Are SBA loans a good option for an arcade startup?SBA 7(a) loans are viable for qualified borrowers and can offer competitive terms and longer repayment periods. Eligibility depends on credit, collateral, and a robust business plan. SBA 7(a) loans can be used for equipment, working capital, and real estate.

How can I convince investors or lenders my arcade will succeed?Provide realistic financial projections, local market research, supplier quotes, and a clear marketing plan. Demonstrate operational know-how or partner with experienced operators and suppliers. Evidence of demand (pre-sales, community support, or trial pop-ups) helps credibility.

How can Guangzhou Dinibao help my financing case?Guangzhou Dinibao provides detailed equipment quotes, project timelines, design and operation proposals, and references from thousands of centers worldwide. These materials strengthen loan applications and investor pitches by showing proven supply chains and implementation plans.

What are common pitfalls to avoid when financing an arcade startup?Underestimating working capital needs, over-leveraging with high-cost debt, and ignoring local regulatory costs are common mistakes. Also, avoid overbuying machines before demand is proven. Start with a conservative plan and scale after validating demand.

How to Win Any Claw Machine Game — Practical Tips from Arcade Experts

How to Start an Arcade Game Business in Azerbaijan: Complete Step-by-Step Guide

How to Start an Arcade Game Business in Afghanistan: A Practical Guide

The arcade racing machines Cost Guide

Questions you may concerned about

Road Rider

Do you provide bulk purchase options?

Yes, as a global arcade machine supplier, we offer competitive pricing for bulk orders.

Table Football /Pinball machine

Is this machine suitable for children?

Yes, it is safe and fun for kids aged 6 and up, with adult supervision recommended for younger players.

Snow Storm

Where can I buy replacement parts for Snow Storm?

Replacement parts can be purchased directly through our official distributor network or by contacting our customer service team.

Train Baby

How is hygiene ensured?

The toy guns are sanitized between uses, ensuring clean and safe play for every child.

Get in Touch with us

If you are interested in our products and services, please leave us messages here to know more details.

We will reply as soon as possible.

Scan QR Code

Scan QR Code

Youtube

Guangzhou DiniBao Animation Technology Co., Ltd

Guangzhou Dinibao Animation Technology Company Co., Ltd